Accounting policy in 1s 8.3 for basic purposes. Accounting info. Registration of a return invoice

The key to proper accounting and tax accounting in the 1C Accounting 8 program is the correct setting of accounting parameters and accounting policies. 1C developers tried to make these settings simple and understandable. However, there are a number of pitfalls that even experienced users can stumble over.

Of course, we could limit ourselves to presenting a list of these pitfalls. Unfortunately, each user has their own pitfalls. Therefore, the article describes the meaning and purpose of each settings parameter.

In the 1C Accounting 8 program there is no single object where it would be possible to describe the accounting policies of the organization. Someone will object, what about the periodic register of information “Accounting Policies of Organizations”? Yes, there is such a register. However, it plays a subordinate role in relation to the “Set up accounting parameters” form. In addition, certain accounting policies are defined in the corresponding configuration documents. As a result, it turns out that the entire accounting policy must be described at three levels of the hierarchy, starting from the top level.

- Top level. Determined by the settings in the “Configuring Accounting Parameters” form.

- Average level. Determined by entries in the information registers “Accounting policies of organizations” and “Accounting policies (personnel)”.

- Lower level. Defined by some documents.

1) Why in one information base (IS) for any organization you can choose any taxation system: OSN or simplified tax system. And in another information security program, the program allows you to specify, for example, only the simplified tax system!!!

2) The help to the form “Setting up accounting parameters” says literally the following: “The form is intended for setting accounting parameters that are common to all information base organizations.” From this we can easily conclude that the effect of the parameter set in this setting certainly applies to all organizations of the enterprise. In fact, this rule does not always apply so clearly.

3) Refusal in accounting policy, for example, from conducting calculations in an accounting program, blocks the relevant documents. But the absence in the accounting policy of an indication of conducting, for example, production activities does not block the corresponding documents in the program.

Since the volume of material is large, the article consists of three parts.

- 1C Accounting 8. Part 1: Setting up accounting parameters.

- 1C Accounting 8. Part 2: Accounting policies of organizations.

- 1C Accounting 8. Part 3: Accounting policies in configuration documents.

1C Accounting 8. Part 1: Setting up accounting parameters

The parameter values specified in the “Configuring Accounting Parameters” form directly affect the setting of accounting policies. It is for this reason that you should start not with the “Accounting Policies of Organizations” register, but with the “Setting Accounting Parameters” form. You can open it, for example, using the “ENTERPRISE Setting up accounting parameters” command.Tab “Types of activities”

At first glance, this bookmark does not raise any questions. But it is precisely on it that a time bomb is laid.However, let's take things in order. The tab clearly displays two types of activities.

- Flag “Production of products, performance of work, provision of services.”

- Flag "Retail".

Flag “Production of products, performance of work, provision of services.”

The guidelines state that this flag should be set if at least one of the enterprise organizations is engaged in the production of products, performance of work or provision of services. After setting the flag, another bookmark will be displayed. This is the "Production" tab. It is necessary to indicate the type of price that will play the role of the planned cost for the products (works, services).

Flag "Retail".

The flag should be set if at least one of the enterprise's organizations is engaged in retail trade. After setting the flag, another bookmark will be displayed. This is the “Retail Products” tab. On it you can specify additional analytics for accounting for goods sold at retail through a manual point of sale (NTP).

Displaying the “Retail Products” tab may provoke a false conclusion. It’s as if the “Retail trade” flag should be set only if an organization wants to set up additional analytics for retail trade via NTT. Not only! The state of the flag is very important for determining the accounting policy of the organization.

Setting these flags has variable effects. So, if in the form “Setting up accounting parameters”, the flag “Production of products, performance of work, provision of services” is set, then in the information register “Accounting policies of organizations” for any organization it will be possible to either confirm or refuse to conduct production activities (works, services). The same applies to the Retail flag.

On the contrary, clearing these flags has an unconditional effect on accounting policy. In this case, the program will not allow any organization to indicate such types of activities as retail trade or production activities in the “Accounting Policies of Organizations” information register.

In order to properly conduct manufacturing and retail activities, it is very important to remember the following.

Attention. The state of the flags “Production of products, performance of work, provision of services” and “Retail trade” does not prohibit the conduct of production activities and activities related to retail trade in the program. And it's very bad.

This state of affairs can lead to serious accounting errors. For example, if the “Production of products, performance of work, provision of services” flag is cleared, the program does not block the documents “Request-invoice” and “Production report for the shift.” It allows you to arrange and carry them out.

Therefore, if an accountant conducts production activities without indicating it in the accounting policy, then when closing the month there will be errors in the process. In turn, this will lead to incorrect calculation of the actual cost of finished products and adjustments to output. Cost accounts will not be closed correctly.

A similar situation will arise if the accounting policy does not specify the type of activity “Retail trade”, but the accountant nevertheless registers retail transactions.

Attention. Accounting policy provisions are used in month-end closing regulations.

Of course, it would be better if the program could block transactions that do not comply with accounting policies. Unfortunately, this is not provided everywhere. How to be?

No need to split hairs. If the organization conducts production activities, be sure to set the flag “Production of products, performance of work, provision of services.” The same applies to retail.

It can be assumed that the presence of the “Types of Activities” tab is due to the possibility of multi-company accounting in one information base. And, probably, because even for single-company accounting there can be organizations with a very large amount of information.

These circumstances can lead to a noticeable increase in the closing time for the month. However, in the overwhelming majority of cases, there is no meaningful need for multi-company accounting. Also, a huge number of organizations have quite small information databases.

For such organizations, in order to protect themselves, it is advisable to set the flags “Production of products, performance of work, provision of services” and “Retail trade”. Regardless of whether or not the organization has production activities and retail trade.

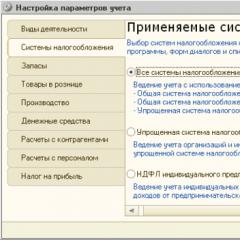

Tab "Taxation systems"

This tab indicates those taxation systems that will be available in the “Accounting Policies of Organizations” information register.

All taxation systems.

Setting this flag has a variable effect on accounting policies. More precisely, when you activate this radio button for any organization of the enterprise in the information register “Accounting policies of organizations”, you can specify one of the following taxation systems.

- General taxation system in organizations.

- General system of taxation of entrepreneurs (NDFL).

- Simplified taxation system for organizations and individual entrepreneurs.

Simplified taxation system.

Activating this radio button has an unconditional effect. When activated, in the information register “Accounting Policies of Organizations” it will be possible to indicate only the simplified tax system for organizations or individual entrepreneurs.

Personal income tax of an individual entrepreneur.

The presence or name of this radio button confuses even users who are well aware of the tax system. Here is a typical reasoning.

The name of the tab “Taxation Systems” means that all taxation systems should be listed on it. And in this sense, the names of the radio buttons “All taxation systems” and “Simplified taxation system” correspond to the user’s expectations. But the name of the radio button “Individual Entrepreneur Personal Income Tax” is confusing. There is no such taxation system in the Tax Code of the Russian Federation.

True, under this radio button there is explanatory text: “Keeping records of individual entrepreneurs paying personal income tax on income from business activities.” But it doesn’t help everyone either.

In fact, activating the “Individual Entrepreneur Personal Income Tax” radio button means the following. The accounting policy certainly establishes only the SST for individual entrepreneurs. But the same can be done by selecting “All taxation systems”, and then for an individual entrepreneur, indicate the DOS in the accounting policy.

It seems that there would be less misunderstandings if the “All Tax Systems” tab included the following radio buttons.

- All tax systems. For organizations and individual entrepreneurs at the choice of OSN or simplified tax system.

- General taxation system. For organizations and individual entrepreneurs only OSN.

- Simplified taxation system. For organizations and individual entrepreneurs only the simplified tax system.

Activating this radio button hides the “Income Tax” tab.

Tab "Inventory"

There is no ambiguity on this tab.

Let us recall that in accounting, inventories are recorded in the following accounts.

- Account 07, Equipment for installation.

- Count 10,Materials.

- Count 21, Semi-finished products of own production.

- Score 41, Goods.

- Score 43, Finished products.

At the initial stage of putting a program into operation, this situation often arises. There are actually goods and materials in the warehouse. However, they have not yet been entered into the program in the form of initial balances. However, in current activities, the accountant needs to register the write-off of materials for production or the shipment of goods to customers.

In this situation, it is advisable to set the flag “Write-off of inventories is allowed if there are no balances according to accounting data.” This will allow the accountant to post documents. Of course, negative debit balances will appear on the inventory accounts.

It's OK. Once all opening balances have been entered and verified, these red minuses will disappear. After this, it is strongly recommended to clear the checkbox “Write-off of inventories is allowed if there are no balances according to accounting data.” This will allow the program to control attempts to write off something that is not in stock.

Attention. Unfortunately, any state of the flag “Write-off of inventories is allowed if there are no balances according to accounting data” applies unconditionally to all organizations of the enterprise.

What does this affect? With multi-company accounting in different organizations of the enterprise, the initial balances are usually entered in full at different times. Therefore, if in some organization the opening balances were entered first, then the accountant of this organization will not be able to prohibit the write-off of missing inventories. We will have to wait until all organizations have deposited their balances.

Obviously, this is very inconvenient for multi-company accounting.

The flag “Returnable containers are kept in check.”

Setting the flag will lead to the appearance of the “Containers” tab in the receipt and expenditure documents for inventory accounting. This flag should be set if at least one organization of the enterprise keeps records of returnable packaging.

Attention. It is a pity that the accounting policy does not provide for a variable choice of packaging accounting.

Therefore, if at least one organization keeps records of containers, then all other organizations of the enterprise will be forced to put up with the unnecessary “Container Accounting” tab in their invoices.

The “Setting up analytical accounting” section allows you to enable or disable additional analytics on inventory accounts.

Flags “Recording is maintained by batches (receipt documents).”

Keeping records by batch is one of the most important functional features of the accounting program on the 1C Enterprise 8 platform. This was not the case in the 1C Accounting 7.7 program. At the request of the seven accountants, programmers contrived to set up batch accounting.

Now there is no need to get creative. Just check the “Accounting is maintained by batches (receipt documents)” flag.

Setting this flag will result in the automatic addition of the “Parties” subaccount to the Inventory accounts. Since many of these accounts have a tax accounting (TA) attribute, party accounting will be maintained not only in accounting (AC), but also in TA.

Removing the flag leads to the removal of the “Party” sub-account on these accounts.

Setting the flag “Accounting is maintained by batches (receipt documents)” has a variable effect. That is, in the accounting policy, an organization can choose the “By average cost” or “By FIFO” method.

If the flag “Accounting is maintained by batches (receipt documents)” is cleared, then only one option remains: “At average cost”. True, the user can still indicate the “FIFO” method in the “Accounting Policies of Organizations” information register. In this case, the program will warn you that you need to add the “Parties” subaccount on the corresponding accounts.

There is no need to open the “Configuring Accounting Parameters” form specifically for this. If the user continues to insist on the “FIFO” method, then the program will connect the “Parties” subaccount directly from the accounting policy to the accounts.

Quantitative and total accounting is always maintained on the inventory accounts for the “Nomenclature” and “Parts” subcontos. This is provided by the configuration. But when accounting by warehouses, three alternative options are possible.

1. Accounting for warehouses (storage places) “Not maintained.”

If you activate the “Not maintained” radio button, then the “Warehouses” subaccount will be removed from the inventory accounts. In this case, the “Warehouse” attribute will remain in the receipt and write-off documents, but it will not be used when posting documents.

Of course, if accounting for warehouses is not maintained, then it makes no sense to talk about either quantitative accounting or total accounting for warehouses. In other words, no information exists regarding warehouses.

Attention. Regardless of the state of this radio button, the following accounts are always accounted for by warehouse.

- Account 41.12, Goods in retail trade (in NTT at sales value).

- Account 42.02, Trade margins in non-automated retail outlets.

2. Accounting for warehouses (storage locations) “Keeps by quantity.”

When choosing this option, the “Warehouses” subaccount is added to the inventory accounts. In the context of this subconto, only quantitative records are maintained. It is advisable to install this option in the case when the same item in different warehouses has the same price. That is, it does not depend on the storage location.

When setting this flag in receipt and write-off documents, the “Warehouse” attribute must be filled in.

3. Accounting for warehouses (storage locations) “Keeps by quantity and amount.”

When choosing this option, the “Warehouses” subaccount is added to the inventory accounts. But now, unlike the previous option, total and quantitative accounting will be carried out in the context of warehouses. The same as for the subconto “Nomenclature” and “Parties”.

This option should be set in the case where the same item item in different warehouses can have different accounting prices.

Tab “Retail Products”

The “Retail Goods” tab is displayed if the “Retail Trade” flag is set on the “Types of Activities” tab.

First of all, please note that this tab does not detail all retail trade, but only trade through manual retail outlets (NTPs). The following accounts are used for trading via NTT.

- Account 41.12 “Goods in retail trade (in NTT at sales value).”

- Account 42.02 “Trade margins in non-automated retail outlets.”

On the “Retail Goods” tab, you can connect additional analytics, subconto to accounts 41.12 and 42.02.

- Flag “By nomenclature (revolutions)”. Setting the flag will lead to the fact that in account 41.12 “Goods in retail trade (in NTT at sales value)” the subaccount “(about) Nomenclature” is connected. This will allow, for example, in the “Turnover Balance Sheet” report to view debit turnover for this account with detail down to item items. However, since the subconto is negotiable, the report will not show information about the balance of the item in the NTT.

- Flag “At VAT rates”. If this flag is set, then the sub-account “VAT Rates” is connected to accounts 41.12 “Goods in retail trade (in NTT at sales price)” and 41.02 “Trade margin in non-automated retail outlets”.

Any state of these flags certainly applies to all organizations of the enterprise. The chart of accounts is general.

The “Retail Products” tab displays settings only for trading via NTT. This leads to a false conclusion. If organizations conduct wholesale trade and retail trade, but only through ATT, then the “Retail trade” flag does not seem to have to be set. This is wrong!

Attention. If at least one organization of the enterprise conducts any type of retail trade (through ATT and/or NTT), be sure to set the “Retail trade” flag.

“Production” tab

The “Production” tab is displayed if the “Production of products, performance of work, provision of services” flag is set on the “Types of Activities” tab.

In the standard configuration of 1C Accounting 8, accounting of finished products is carried out only at planned prices. Therefore, on the “Production” tab, you should specify the price type that will play the role of the planned price.

Let me explain. A specific product can be manufactured, say, in the middle of the month and sent to the finished goods warehouse, debit account 43 “Finished goods”. This account has a mandatory sub-account “Nomenclature”. Quantitative and total accounting is carried out on this sub-account. This means that when writing off finished products to a warehouse, you must indicate not only the name of the finished product, but also its price.

However, the actual price at the time of product release is usually unknown. It will be known only at the end of the month. When all direct and indirect costs are written off to account 20 “Main production”, to the product group, which includes these products.

And since the actual price is unknown, it means that some other price must be used. Since the actual price during the month is unknown, the standard configuration of 1C Accounting 8 records finished products only at planned prices. At this price, finished products are delivered to the finished goods warehouse. How to calculate the target price is a matter for the planning department of the enterprise.

All price types used at the enterprise are described by the user in the “Item Price Types” directory.

Formally, any element of this directory can be used as a planned price. Of course, the name doesn't matter. Meaningfulness matters.

The products manufactured, the work performed and the production services provided are described in the “Nomenclature” directory. For these items, using the “Setting Item Prices” document for the planned price type, it is advisable to assign specific price values.

After these settings, the values of planned prices (products, works, services) will be automatically inserted into the documents “Production Report for the Shift” and “Certificate of Provision of Production Services”. Otherwise, you will have to enter them manually each time.

Tab "Cash"

Setting the flag “By cash flow items” adds the subconto “(about) Cash flow items” on the following cash accounting accounts.- Account 50. Cash desk.

- Account 51. Current accounts.

- Account 52. Currency accounts.

- Account 55. Special bank accounts.

In accordance with the order of the Ministry of Finance of the Russian Federation dated July 22, 2003 N 67n “Cash Flow Report (Form No. 4)” the following organizations may not submit.

- Point 3. Small businesses that are not required to conduct an audit of the accuracy of their accounting records.

- Clause 4, para. 1. Non-profit organizations.

- Clause 4, para. 3. Public organizations (associations) that do not carry out entrepreneurial activities and, apart from disposed property, do not have turnover in the sale of goods (works, services), as part of their financial statements.

Attention. Even if your organization does not report on Form No. 4, still check the box in the “Cash” detail. This will greatly help both the accountant and the director when analyzing cash flows.

Tab “Settlements with counterparties”

For management accounting purposes, on this tab for all organizations of the enterprise, you can specify payment terms for customers and payment terms for suppliers.

If necessary, similar parameters can be specified in the agreement with a specific counterparty. The payment terms specified in the agreement with the counterparty for the program are of higher priority than the payment terms specified in the accounting settings.

Arrears based on payment terms can be further analyzed in the reports of the Anti-Crisis Management Center. It is located on the function panel, on the “Manager” tab. There are two groups of reports on debt settlements.

Settlements with buyers.

- Dynamics of customer debt.

- Buyers' debt.

- Buyers' debt by debt terms.

- Overdue debt from buyers.

- Dynamics of debt to suppliers.

- Debt to suppliers.

- Debt to suppliers by debt terms.

- Overdue debts to suppliers.

Tab "Accounts with personnel"

The parameters set on this tab certainly apply to all organizations of the enterprise.

Payroll accounting and personnel records.

In this section, you must indicate in which program you plan to keep personnel records and perform payroll calculations.

- In this program. Activation of this radio button indicates that payroll calculations and personnel accounting are planned to be performed in the 1C Accounting 8 program.

- In an external program. Activation of this radio button indicates that payroll calculations and personnel accounting are planned to be performed in an external program. Usually this is a specialized program 1C Salary and personnel management 8.

Analytical calculation with personnel.

Settlements with personnel can be carried out collectively for all employees or separately for each employee.

- For each employee. This radio button must be activated if personnel accounting and salary calculations are performed in the 1C Accounting 8 program. Otherwise, it will be impossible to generate those regulated reports that indicate information for each employee. For example, prepare data for transfer to the Pension Fund.

- Summary for all employees. It is advisable to activate this radio button if personnel accounting and salary calculations are performed in an external program, for example, 1C Salary and personnel management 8.

- Account 70 “Settlements with personnel for wages”.

- Account 76.04 “Settlements on deposited amounts.”

- Account 97.01 “Payroll expenses for future periods.”

Accountants often have a question about which analytics option to choose: “For each employee” or “Summary for all employees.” For calculations in the accounting program itself, everything is usually clear: only “For each employee.”

But for calculations performed in an external program, there are options. And some accountants, without hesitation, choose the first option - “For each employee.” The following arguments are usually given in favor of such a decision.

- Salary calculations must be carried out for each employee. Who can argue against this! But the accounting program does not need this information. All detailed calculations for employees are carried out in an external program, for example, 1C Salary and personnel management 8.

- It is necessary to generate standard reports in an accounting program. Of course you can, but you shouldn’t kill your accounting program for the sake of it. The 1C Salary and Personnel Management 8 program has many specialized reports on personnel accounting and accruals. Moreover, such reports do not even exist in the accounting program.

- It is necessary to prepare and generate regulated reports on payroll calculations. All regulated reports can be prepared in the 1C Salary and Personnel Management 8 program. If desired, the accountant can prepare some of these reports in the accounting program after a consolidated loading of data from the calculation program.

- In the accounting program, you must have all the postings for accruals and deductions for each employee. For what?

Let us recall that personnel accounting and payroll calculations in the 1C Salary and Personnel Management 8 program assumes that monthly calculation data is uploaded from this program to the 1C Accounting 8 program. Depending on the settings, they will be uploaded collectively or separately for each employee.

Let's assume that employees only have a salary. For this case, the settlement program creates 7 accounting entries for each employee. This includes payroll and personal income tax and 5 entries for insurance premiums. This means that if there are 100 people in an organization, then 8,400 accounting entries need to be downloaded per year.

And, if we add here sick leave, insurance payments, allowances, compensation, bonuses, etc. the number of uploaded transactions will increase even more.

The question arises: why should an accounting program be loaded with unnecessary information every month? Swelling of the information base can lead to a significant decrease in the performance of the accounting program.

Therefore, if there are no serious items to upload with detail by employee, we upload them in summary form. When preparing regulatory reports, if something doesn’t go well in terms of payroll calculations and insurance premiums, the accountant can easily determine where the ears are coming from. Gives instructions to the calculator. It finds errors, corrects them, and uploads the updated data back into the accounting program.

Tab “Income Tax”

The “Income Tax” tab is displayed if the “All taxation systems” flag is selected on the “Taxation systems” tab. Having reached this tab, some accountants remain perplexed for a long time. Why are there different income tax rates?

The “Different income tax rates apply” flag.

The general tax rate for income tax in the amount of 20% is established in paragraph 1 of Art. 284 Tax Code of the Russian Federation. In this case, it is distributed as follows.

- 2 % the tax amount is subject to credit to the federal budget of the Russian Federation.

- 18 % the tax amount is subject to credit to the budgets of the constituent entities of the Russian Federation.

Thus, if multi-company accounting is maintained in the information base and if all organizations of the enterprise are registered in one subject of the federation, then the flag “Different income tax rates apply” must be cleared. In this case, uniform profit tax rates for all organizations are established in the periodic information register “Income Tax Rates”.

This register does not indicate the organization. This indicates that the rates specified in it apply to all organizations of the enterprise. If in the subject of the Russian Federation where all these organizations are registered, a reduced income tax rate is applied, then it is enough to manually replace 18% with the desired value.

A different situation arises when several conditions are met simultaneously.

- The program maintains multi-company accounting.

- There are at least two enterprise organizations registered in different federal subjects.

- These federal subjects have reduced income tax rates.

Please note that now it does not display rates in the constituent entity of the Russian Federation. The rates of the constituent entities of the Russian Federation are described in another periodic register of information “Rates of income tax to the budget of the constituent entities of the Russian Federation.” The figure shows one possible option for filling it out.

Section “The cost of property and services pre-paid under the agreement in foreign currency is determined as of the date.”

This section is important for those organizations that are engaged in foreign economic activity. For example, they import and or export goods. In this case, advance payment for purchased or sold property is made in foreign currency. In this case, it becomes necessary to convert foreign currency into rubles.

Federal Law of December 28, 2010 No. 395-FZ in the Tax Code of the Russian Federation in paragraph 8 of Article 271, paragraph 10 of Article 272 and paragraph. 3 clause 316 of the Tax Code of the Russian Federation, additions have been made regarding the accounting of advances denominated in foreign currency. They came into force on January 1, 2010, based on the provisions of paragraph 3 of Art. 5 FZ-395.

Attention. According to these additions, in the case of receipt (transfer) of an advance, income (expenses) expressed in foreign currency are converted into rubles at the rate of the Central Bank of the Russian Federation on the date of receipt (transfer) of the advance.

The procedure for accounting for income and expenses expressed in foreign currency remains the same. Income (expenses) expressed in foreign currency are recalculated for tax purposes into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of recognition of the corresponding income (expense).

In this regard, the radio buttons listed below have the following meaning.

- Receipts or sales of property and services. Until December 31, 2009 inclusive, the cost of property and services pre-paid under an agreement in foreign currency was assessed at the exchange rate on the date of receipt or sale of this property and services. In other words, starting from 01/01/2010 this radio button cannot be used.

- Receiving or issuing an advance. It is this radio button that must be activated from 01/01/2010. From this date, the cost of property and services pre-paid under the contract in foreign currency is assessed at the exchange rate on the date of receipt or issuance of the advance.

The “Applies from” attribute automatically indicates the date from 01/01/2010. The program will not allow you to change it to an earlier date. But if accounting in the program began, for example, on 01/01/2011, then you can specify this date. Although this is not necessary.

conclusions

Let's summarize.1. Before filling out the information register “Accounting Policies of Organizations”, be sure to fill out the “Setting up Accounting Parameters” form. The fact is that even for a pure infobase in this form there are default settings. They may not comply with your organizations accounting policies.

2. Some settings of the “Configuring Accounting Parameters” form are not visibly reflected in the “Accounting Policies of Organizations” information register. However, they must be treated very carefully. Otherwise, errors in the information base are very possible.

3. Some settings in the “Setting up accounting parameters” form certainly apply to the accounting policies of all organizations of the enterprise. For example, you refused to account for containers. It's OK. You can open the “Configuring accounting parameters” form again and reconfigure it, that is, specify container accounting.

4. Not all parameters of the “Set up accounting parameters” form are elements of accounting policy. For example, “Container accounting” is not an element of the accounting policy. This means that if records have already been kept in the information base, then after changing the state of the flag, for example, “Container accounting”, there is no need to re-enter the documents.

5. Some parameters of the “Configuring Accounting Parameters” form determine the accounting policies of organizations. For example, the flag “Production of products, performance of work, provision of services.” Therefore, if the state of this flag changes, it is necessary to perform a group re-posting of documents.

May cause errors when working with documents and reports. The choice of accounting policy parameters depends only on you. For our part, we offer a brief explanation for understanding the accounting policy settings in the 1C: Accounting 8 program, ed. 3.0.

Filling out accounting rules in 1C

Working with the 1C program begins with filling out primary information about the organization (“ Main" - "Settings" - "Organizations""). Once the data is filled in, you can proceed to the next step - filling out the accounting policy (“ Main” – “Settings” – “Accounting policy"). This section sets out the rules for maintaining accounting records.

"Applies with"– in this field we set the start date of the accounting policy.

Method for assessing MPZ

The method for valuing inventories (MPI) is important, since the purchase price of the same material may not be stable even from the same supplier. The program offers 2 assessment methods.

On average– when writing off inventories, the value is determined by the average cost, i.e. quotient from dividing the sum of the costs of all available units of one material (from all batches) by the number of units of this material.

By FIFO(First In First Out, “first in - first out”) - this method involves taking into account the price in each batch, while the oldest product is written off: the quotient of dividing the total cost of batch 1 by the number of materials in batch 1.

Rice. 1 Example of filling out accounting rules for an LLC in 1C: Accounting 8, ed. 3.0

Method for evaluating goods in retail

This point is relevant for retail outlets, automated (ATT) or non-automated (NTT):

at acquisition cost– this item will be useful for retail outlets where it is important to track goods at cost.

at sales price– the goods are valued at the selling price, with the markup reflected on account 42. When selecting this item for NTT, additional settings are required in “ Administration» – « Accounting parameters» – « Setting up a chart of accounts» – « Retail goods accounting».

G/L Cost Account

In this paragraph you need to reflect the main cost account. The default value is 26 – it is entered automatically in documents so that you can fill them out faster. If most of the documents should reflect expenses on another account, in the menu “Main” - “Settings” - “Chart of Accounts” you can view all the accounts and select the one you need.

If a company provides services or produces something, then we mark it with checkboxes in the following positions: “ Output" or/and " Carrying out work and providing services to customers" Paragraph " Execution of work, provision of services to customers" activate the choice of cost write-off method:

Excluding revenue, i.e. When closing the month, costs will be written off to the cost price for all elements, even if revenue is not reflected for them.

Taking into account all revenue– this option is selected to write off costs for all item items for which revenue is reflected (document “ Implementation"), and the remainder remain in the main expense account, which may result in the expense account not being closed at the end of the month.

Including revenue from production services only– taking into account revenue only from production services – costs are written off exclusively for items of the nomenclature, reflecting revenue from production services (document “ Provision of production services»).

General business expenses include:

to the sales account when closing the month when selecting the item “ In the cost of sales (direct costing)".

included in management and are written off as goods are sold when selecting item “B” cost of products, works, services". In this way, costs will be distributed between cost of goods manufactured and work in progress.

Methods for allocating indirect costs

Allocation methods can be useful when different types of expenses require different allocation methods, which can be detailed by department and cost item. Also, the costs filled out in this list are written off in full when the operation is carried out. "Closing of the month", since they are indirect.

Take into account deviations from the planned cost

This item is checked if cost control is required. In the “turnover” on account 40 you can see the actual, planned and difference amounts.

Calculate the cost of semi-finished products

This item is noted if the production process includes the production of semi-finished products that need to be stored somewhere (reflected on 21 invoices).

The cost of services to own divisions is calculated

We mark this item if there are several departments that provide services to each other. For example, the presence of a repair shop at a factory.

Account 57 “Transfers in transit” is used

We check the box if we want the movements to be reflected in the 57th count. It makes sense if you have several accounts, or withdraw/deposit cash from a current account in

Provisions for doubtful debts are formed

Formation of a reserve for Dt 91.02 and Kd 63 for debts in settlements with customers on accounts 62.01 and 76.06. The reserve begins to accrue if the debt is not repaid within the time specified in the agreement. If the agreement does not specify a payment period, the debt is considered outstanding after the number of days specified in the accounting policy (“Administration” – “Program settings” – “Accounting parameters” – “Customer payment terms”).

PBU 18 is used

Accounting for income and expenses in accounting and tax accounting differs. If the checkbox " PBU 18 “Accounting for settlements in the organization” is applied", then it becomes possible to reflect deferred and permanent assets and liabilities using temporary and permanent differences. Permanent differences give rise to permanent tax assets and permanent tax liabilities; temporary differences give rise to deferred tax assets and deferred tax liabilities.

Composition of financial reporting forms

At this point you can select the type of forms (tax returns, statistical forms, certificates, etc.)

Filling out tax accounting rules in 1C

Rice. 2. An example of filling out tax accounting rules for an LLC in 1C: Accounting 8, ed. 3.0

Tax system

This paragraph makes it possible to specify the taxation system, as well as the use of special regimes. Availability of a trade tax for those actually engaged in certain types of activities in the city

Income tax

Tax rates may vary for separate divisions if they have the option to do so.

Depreciation method. By default, “ Linear method" depreciation charges (i.e. the same amount every month for a certain time). Nonlinear is used if it is necessary to pay off depreciation faster or slower than linear. In this case, depreciation is accrued not per item item, but for the entire item group.

Method of paying off the cost of workwear and special equipment. One-time The repayment method involves a one-time write-off of costs for workwear and special equipment; if the useful life is more than 12 months and the amount is more than 40,000 rubles, then at the end of the month a temporary difference will be formed.

Indicated upon commissioning. This option allows you to choose a method of paying off the cost immediately at the time of transfer of workwear or special equipment into operation.

Create reserves for doubtful debts. The formation of a reserve for doubtful debts in tax accounting is similar to the formation of a reserve in accounting. The difference lies in the percentage of revenue that is set aside to form a reserve.

List of direct expenses. This list includes all direct costs (material, labor, depreciation, other, etc.) associated with production and provision of services. The rules for determining these expenses are indicated. Unlike indirect expenses, they will be written off at the end of the month in relation to the amount of product sold.

Nomenclature groups for the sale of products and services. It is necessary to create group data, since item groups are analytics for 20 and 90 accounts, otherwise you will have an empty subaccount. If there is no need to keep track of costs and sales by item groups, then one is still created - the main item group. Revenue from the product groups specified in this paragraph will be included in the income tax return section as revenue from the sale of products or services.

Procedure for making advance payments. Monthly advance payments are paid by everyone, except those organizations specified in clause 3 of Art. 286 Tax Code of the Russian Federation. Quarterly– this procedure is used if your organization belongs to the budgetary, autonomous, non-profit and others from clause 3 of Art. 286 Tax Code of the Russian Federation. Monthly according to estimated profit– under this procedure, the uniform payment is determined from the estimated profit, the amount of which is calculated based on the results of the previous quarter. Payment amounts paid earlier are taken into account, but without a cumulative total. Monthly based on actual profit – when choosing this order, there may be uneven advance payments, since they are calculated taking into account previously paid ones, with a cumulative total.

VAT

This paragraph establishes the rules related to maintaining separate VAT accounting, as well as exemption from

An organization is exempt from paying VAT in the case provided for in Art. 145 of the Tax Code of the Russian Federation, i.e. if the last three months the total amount of revenue from transactions with non-excise goods did not exceed 2 million rubles.

Checkbox « Separate accounting of incoming VAT is maintained" mandatory if taxable and non-taxable (or export) activities are carried out. VAT is reflected on account 19. You also need to go to “Administration” – “Program Settings” – “Accounting Options/Chart of Accounts Settings” – “Accounting for VAT Amounts on Purchased Values” and check the “ By accounting methods".

Parameter " Separate VAT accounting by accounting methods» will be useful for organizations engaged in exporting or exempt from tax for certain activities, if analytics on tax accounting methods is important. This checkbox allows you to choose the method of VAT accounting (accepted for deduction, distributed, etc.).

“VAT is charged on shipment without transfer of ownership” – VAT is accrued at the time of shipment of the goods, if the transfer occurs in a special manner (after payment, after acceptance for accounting, etc.).

We also indicate the procedure for registering invoices for advance payments:

Always register invoices upon receipt of an advance. With this option, invoices for advances received will be created for each amount received, except for advances credited on the day of receipt. If the shipment occurred on the day of payment, then an advance invoice is not created.

Do not register invoices for advances offset within 5 calendar days. An invoice is created only for those advance amounts that have not been offset within 5 days after receipt.

Do not register invoices for advances cleared before the end of the month. This position is relevant only for those prepayment amounts that are not offset during the tax period (quarter) in which they were received.

Do not register invoices for advances (Clause 13, Article 167 of the Tax Code of the Russian Federation). Option only for organizations whose activities fall under clause 13 of Art. 167 of the Tax Code of the Russian Federation, i.e. production cycle duration is more than 6 months.

Personal income tax

Standard deductions apply:

Cumulatively during the tax period, those. The standard tax deduction is provided to the employee in the appropriate amounts for each month of the tax period evenly.

Within monthly income – standard tax deductions do not accumulate during the tax period and are not subject to cumulative summing.

Insurance premiums

Contribution rates for all organizations are established, except for the organizations specified in Art. 57 No. 212-FZ. Reduced insurance premiums are possible for them.

Accident contribution rate also specified in Law No. 179-FZ.

The remaining taxes and reports are filled out if there is property, transport, sales of alcoholic/excise products, etc.

Don't forget to look at the section “Administration” – “Program settings” – “Accounting parameters» to check accounting parameters, and functionality ( “Administration” – “Program settings” – “Functionality”") for the program to work correctly.

VAT accounting policy 1C

The accounting policies of organizations in the 1C Accounting 8 program are the most important stage of its setup and proper operation. But before describing the elements of accounting policy in 1C, we note the following point. Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation provides two methods for determining income and expenses. These are the accrual method and the cash method. The cash method has restrictions on its use provided for by law. Simply put, not all organizations and individual entrepreneurs have the right to use it. The accrual method can certainly be used.

In the 1C Accounting 8 program it is used accrual method. It cannot be replaced by the cash method of determining income and expenses. You need to come to terms with this.

The accounting policies of organizations in 1C Accounting 8 are described in several information registers.

- Accounting policies of organizations

- Methods for distributing general production and general business expenses of organizations. Periodic within a month independent register of information.

- The order of divisions for closing accounts. Periodic within a month register of information subordinate to the registrar “Establishing the order of divisions for closing accounts.”

- Methods for determining direct production costs in tax accounting. Periodic daily independent register of information.

- Accounting policy (personnel)

- Accounts with a special revaluation procedure (accounting). Not a periodic register of information.

- Counter production of products (services) and write-off of products for own needs. Periodic within a month independent register of information.

The information register “Accounting policies of organizations” can be called the main control panel for setting up accounting policies in 1C. It contains links to many of the information registers listed above. This means that it is not necessary to open these registers separately for editing. They can be filled in during the process of setting up the “Accounting Policies of Organizations” register.

Register of information “Accounting policies of organizations”

The frequency of the information register “Accounting policies of organizations” is one year. This means that entries in this register can be changed no more than once a year. If an organization annually or over a long period changes its accounting policy, then it is registered with the corresponding entries in this register.

The information register form “Accounting policies of organizations” consists of several tabs. The set of details on them is determined by the state of the “Setting up accounting parameters” form.

Before setting up an organization's accounting policy, be sure to fill out the form“Setting up accounting parameters.”

Let's study the contents of each accounting policy settings tab in 1C.General information

The state of this tab is determined by the accounting settings.

Props "Organization".

The information register “Accounting policies of organizations” describes the accounting policies for all organizations of the enterprise. However, each entry in this register always belongs to a specific organization. This is a required requirement.

Props “Applicable from ... to.”

The user specifies only the start of the new entry. The program automatically sets its end on December 31 of the year the entry begins. If in the coming new year the accountant did not enter a new entry, that is, he left the previous accounting policy in effect, then the program in the “by” attribute will automatically be set to December 31 of the new year. And so on.

Group of radio buttons “Taxation system”.

If in the “Setting up accounting parameters” form, on the “Taxation systems” tab, the “All taxation systems” radio button is activated, then for any organization and for any individual entrepreneur you can select the OSN or the simplified tax system.

If in the “Setting up accounting parameters” form the radio button “Simplified taxation system” or “Personal income tax of an individual entrepreneur” is activated, then there will be no choice in the accounting policy.

Requisite “A special taxation procedure is applied for certain types of activities.”

Setting this flag means that, regardless of the taxation system used, this organization has activities subject to a single tax on imputed income, UTII. Setting this flag will display the “UTII” tab for additional settings.

Group of checkboxes “Types of activities”.

If in the “Setting up accounting parameters” form, on the “Types of activities” tab, the “Production of products, performance of work, provision of services” and “Retail trade” flags are set, then in the accounting policy of a particular organization it will be possible to set or refuse these types of activities.

On the contrary, if the flags “Production of products, performance of work, provision of services” and “Retail trade” are cleared, then similar flags will not be displayed in the accounting policy. As a result, the accountant will not be able to set production activities and/or retail trade in the accounting policy.

If the “Production of products, performance of work, provision of services” and “Retail trade” flags are cleared in the “Setting up accounting parameters” form, then under no circumstances reflect production activities and retail trade in the program. This will lead to errors in the infobase when closing the month.

USN in 1C

The simplified tax system in 1C is possible if a simplified taxation system, simplified tax system, is installed on the “General Information” tab. In this case, the simplified tax system tab will be displayed in the accounting policy form. The scope of further settings depends on the taxable object. If you plan to keep only income records under the simplified tax system, then activate the “Income” radio button.

Object of taxation.

An organization or individual entrepreneur using the simplified tax system pays a single tax. Its rate is determined by the object of taxation.

- Income. The single tax rate is 6%.

- Income reduced by expenses. The single tax rate is 15%. When you select this option, an additional Expense Accounting tab will appear.

Details “Date of transition to simplified tax system”.

According to paragraph 1 of Art. 346.13 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs who wish to switch from the OSN to the simplified tax system must submit an application in the period from October 1 to November 30 of the year preceding the year from which they switch to the simplified taxation system. That is, the transition date is always January 1 of the first year of application of the simplified tax system.

Form No. 26.2-1 “APPLICATION on the transition to a simplified taxation system” was approved by order of the Federal Tax Service of Russia dated April 13, 2010 N MMV-7-3/182@ “On approval of document forms for the application of a simplified taxation system.”

Flag “Control of provisions of the transition period”.

It is likely that after the transition to the simplified tax system, the organization has unfinished contracts that began last year under the simplified tax system. In paragraph 1 p. 346.25 of the Tax Code describes the amounts that are included or excluded from the tax base under such agreements.

For example, an organization, while on the simplified tax system, received an advance payment under a contract, the execution of which is completed after the transition to the simplified tax system. When the “Control of provisions of the transition period” flag is set, the program will include this amount of money in the tax base on the date of transition to the simplified tax system.

Notification of the transition to a simplified taxation system.

After submitting an application for transition to a simplified taxation system in Form No. 26.2-1, the taxpayer must receive a “Notification of the possibility of applying a simplified taxation system” in Form No. 26.2-1. The details of this form should be indicated in this section.

Chapter 26.2 of the Tax Code of the Russian Federation does not contain a norm obliging the tax authority to confirm the possibility or impossibility of applying the simplified tax system. If an organization complies with all the restrictions established in Article 346.12 of the Tax Code of the Russian Federation, it has the right to apply the simplified tax system regardless of whether it received a notification from the tax inspectorate or not.

Organizations and individual entrepreneurs who began to use the simplified tax system from the moment of their formation do not need to fill out the last three details.

USN expense accounting in 1C

Accounting for expenses in 1C under the simplified tax system is necessary if “Income minus expenses” is selected as the object of taxation on the simplified tax system tab. In this case, the additional tab “Expense Accounting” is activated. It is easy to guess that in this case it is necessary to keep in 1C Accounting 8 both income and expense accounting.

On this tab, you need to set up the conditions for recognizing material expenses, expenses for the purchase of goods and the condition for recognizing input VAT as an expense.

Surely many users have noticed the interesting behavior of the program. Some expenses from the list of clause 1 of Art. 346.16 of the Tax Code of the Russian Federation, as if by magic, are reflected in the book of income and expenses. And others... at least shoot yourself: they don’t want to be reflected in it! In fact, everything is very simple if all recognized expenses are divided into two groups.

- Expenses as an element of accounting policy. The conditions for recognizing such expenses are determined by the accounting policies of the organization.

- Expenses independent of accounting policies. The conditions for recognizing such expenses are clearly defined in law. They are hardcoded in the configuration. As soon as these conditions are met, the corresponding expense is automatically recognized in tax accounting.

The “Income minus expenses” tab shows expenses, the recognition of which is determined by the accounting policy of the organization.

- Material costs.

- Expenses for purchasing goods.

- Input VAT.

Material expenses, expenses for the purchase of goods and Input VAT are recognized as expenses only if all the conditions specified for them are simultaneously met.

Conditions shown in muted color are not editable. These are mandatory conditions. The presence of editable conditions is mainly due to the ambiguity of the current legislation.

UTII in 1C

The use of UTII in 1C Accounting 8 is also possible. To do this, on the “General Information” tab, check the “Special taxation procedure for certain types of activities applies.” The UTII tab will be displayed.

Flag “Retail trade is subject to a single tax on imputed income.”

In paragraph 2 of Art. 346.26 of the Tax Code of the Russian Federation lists the types of activities in respect of which UTII may be applied. This includes retail trade, but with one limitation.

Retail trade carried out through shops and pavilions with a sales floor area of no more than 150 square meters for each trade facility is not subject to a single tax.

Distribution of expenses by type of activity, taxable or not subject to UTII.

The need to distribute expenses arises when, along with the OSN or simplified tax system, UTII is also used. In this case, those expenses that cannot be clearly attributed to the type of activity taxed by the OSN (STS) or to the type of activity taxed by UTII are distributed according to the specified method and distribution base.

- Distribution method. The distribution method is explicitly set only for the simplified tax system: “For the quarter” or “Cumulative total from the beginning of the year.”

- Distribution base. For the simplified tax system: “Income from sales (BU)”, “Income of total (IN)” or “Income received (IN)”. For OSN: “Income from sales” or “Income from sales and non-operating”.

Button “Set accounts for accounting income and expenses for activities subject to UTII.”

The button opens the information register form “Accounts of income and expenses for activities with a special taxation procedure.” By default, it already describes the necessary accounts.

It is important to remember that in the standard configuration of 1C Accounting 8, special accounts are allocated in the chart of accounts to account for activities subject to a single tax. Their name contains the word “UTII” or “...with a special taxation procedure.”

Under no circumstances should you Accounts intended for UTII should be used in activities with DOS and vice versa.

OS and intangible assets

The state of this tab does not depend on the accounting settings.

The method of calculating depreciation of fixed assets and intangible assets in tax accounting.

The Tax Code (clause 1 of Article 259) provides for two methods of depreciation: linear and non-linear. The taxpayer has the right to choose any of them.

However, regardless of the depreciation calculation method established by the taxpayer in the accounting policy for the depreciation of buildings, structures, transmission devices, intangible assets included in depreciation groups 8-10, the program will apply the straight-line depreciation method. This is the requirement of paragraph 3 of Article 259 of the Tax Code of the Russian Federation.

“Property tax rate” button.

This button opens the “Property Tax Rates” form, which consists of two tabs.

- Property tax rates. This tab displays entries from the periodic register of information “Property Tax Rates”. This register indicates the property tax rate applied to all property of the organization. If there is a tax benefit, it also applies to all property of the organization.

- Property tax rates. This tab displays entries from the periodic register of information “Property Tax Rates”. This register indicates the property tax rate applied to all property of the organization. If there is a tax benefit, it also applies to all property of the organization

- Objects with a special taxation procedure. This tab displays entries from the periodic register of information “Property tax rates for individual fixed assets”. In some cases, legislative (representative) bodies of constituent entities of the Russian Federation may establish benefits for certain property items. In this case, the rate, benefits and other characteristics are indicated in this register for each fixed asset object.

Property tax is described in Chapter 30 of the Tax Code of the Russian Federation and has been in effect since January 1, 2004. The property tax rate is established by the laws of the constituent entities of the federation, but cannot exceed 2.2%, see paragraph 1 of Art. 380 Tax Code of the Russian Federation.

On the tabs of the “Property Tax Rates” form, you are given the opportunity to select one of the following benefits.

- Tax exemption: In Art. 381 of the Tax Code of the Russian Federation defines a closed list of organizations whose property is completely exempt from taxation. This is a federal benefit. When you select the type of organization, the benefit code is automatically set in this detail. Benefit codes are defined in the order of the Ministry of Taxes of March 23, 2004 No. SAE-3-21/224.

- Reduced tax rate to: Based on clause 2 of Art. 372 and paragraph 2 of Art. 380 of the Tax Code of the Russian Federation, legislative (representative) bodies of constituent entities of the Russian Federation have the right to establish a reduced property tax rate for certain categories of taxpayers or certain types of property. This detail indicates the value of the reduced tax rate as a percentage.

- Reducing the tax amount by: According to paragraph 2 of Art. 372 of the Tax Code of the Russian Federation, subjects of the Russian Federation have the right not only to establish a reduced property tax rate. They can determine the procedure and timing of tax payment. There is a practice when a subject of the Russian Federation, using its right, grants an organization the right to pay not all of the calculated property tax, but part of it. For example, 50%. When choosing this option, the percentage of tax reduction is indicated.

Reserves

If in the “Setting up accounting parameters” form, on the “Inventory” tab, the “Accounting is maintained by batches (receipts)” flag is cleared, then the “By FIFO” radio button will still be displayed in the accounting policy.

This means that in the accounting policy you can select the “By FIFO” method. True, the program will warn you that you need to add the “Parties” subaccount to the inventory accounts. If you click on the “OK” button, the program will add the “Batch” subaccount to the inventory accounts.

Regardless of which option for writing off inventories is set in the accounting policy, for sales operations without VAT or with 0% VAT, batch accounting is always maintained, see the “VAT” tab.

In the lower half of the “Inventory” tab, developers simply inform about ways to estimate the cost of inventory for certain cases. They are stitched into the configuration.

Always written off at average cost.

- Materials accounted for in account 003 “Materials accepted for processing.”

- Goods recorded on account 41.12 “Goods in retail trade (in NTT at sales value).”

Always written off using the FIFO method:

- Goods recorded on account 004 “Goods accepted for commission”.

Production and Product Release

Due to its volume, the description of the settings on these tabs became the topic of a separate article. Once it is published, a link to it will appear here.

Retail

The “Retail” tab is displayed if the “Retail” flag is selected on the “General Information” tab.

For retail organizations in paragraph. 2 clause 13 PBU 5/01 establishes two methods of accounting for retail goods.

- By purchase price. Account 42 “Trade margin” is not used.

- By sales price. Account 42 “Trade margin” is used. In this case, for the purpose of accounting for income tax, the amount of direct expenses is determined by the cost of purchasing goods.

If an organization decides to account for retail goods at acquisition cost, then the account is used

- 41.02 “Goods in retail trade (at purchase price).”

For these goods, in the information register “Item Accounting Accounts” for the “Retail” warehouse type, you must specify accounting account 41.02 “Goods in retail trade (at purchase price).”

If the organization decides to account for retail goods at sales value, then the following accounts are used:

- 41.11 “Goods in retail trade (in ATT at sales price).”

- 41.12 “Goods in retail trade (in NTT at sales price).”

- 42.01 “Trade margins in automated retail outlets.”

- 42.02 “Trade margins in non-automated retail outlets.”

For retail goods that are accounted for at sales cost, there is no need to set up the “Item Accounts” information register. The program automatically determines the required accounting accounts depending on the type of warehouse: retail (ATT, automated point of sale) or non-automated point of sale (NTT).

In the 1C Accounting 8 program, accounting for goods at sales price is more labor-intensive than accounting for purchase price.

The fact is that in the 1C Accounting 8 program, the retail sales price is set virtually manually by the document “Setting item prices” for each item item. Then the program automatically calculates the trade margin for each item by subtracting the cost of purchasing the product from the sales price. At the end of the month, the average trading margin is calculated. It is impossible to determine in advance the trade margin for a group of goods.

To fully automate the accounting of goods at sales prices, it is better to use the 1C Trade Management 8 program. It provides the user with several algorithms for setting the trade margin for an arbitrary group of goods.

Income tax

The “Income Tax” tab is displayed only for organizations with a general taxation system.

Button “Specify a list of direct expenses.”

For profit tax purposes, in accordance with paragraph 1 of Article 318 of the Tax Code of the Russian Federation, all production and sales costs are divided into direct and indirect costs. This paragraph also provides an approximate list of expenses that may be classified as direct expenses.

- Material costs. According to paragraphs 1 and 4 of paragraph 1 of Article 254 of the NKRF.

- Labor costs

- Expenses for insurance premiums and contributions to the Social Insurance Fund from NS and PZ. For workers engaged in the production of goods (performance of work, provision of services).

- Amounts of accrued depreciation. For those OS objects that are used in production (performance of work, provision of services).

Expenses not included in the list of direct expenses are indirect expenses of production activities. The taxpayer independently determines in the accounting policy the list of direct expenses associated with the production of goods (performance of work, provision of services). In 1C programs this is recorded as follows.

In the 1C Accounting program 8th edition. 1.6 (not supported since April 2011) two charts of accounts: accounting and tax. In the tax chart of accounts there are direct cost accounts and indirect cost accounts. Therefore, the nature of the expense was determined by the account to which it was written off.

In the 1C Accounting program 8th edition. 2.0 unified chart of accounts. But the accounts on which it is necessary to maintain tax records have the tax accounting sign (TA). For example, on account 26 “General business expenses are a sign of tax accounting.”

In accounting, costs written off to this account are indirect. But in tax accounting they can be both indirect and direct. It turns out that there is one account, but it is somehow necessary to distinguish the nature of costs in tax accounting.

To solve this problem in the 1C Accounting program 8 ed. 2.0 is intended for the periodic register of information “Methods for determining direct production costs in NU”. It is the separator between direct and indirect costs.

Expenses listed in this register are recognized as direct expenses in tax accounting. Expenses not indicated in this register are recognized as indirect expenses.

The figure shows a fragment in the form of a selection from the debit of account 20.01 “main production” from the demonstration database.

Mandatory details of the information register “Methods for determining direct production costs in NU” are “Date”, “Organization” and “Type of expenses of NU”. The remaining details listed below are not required to be filled out.

- Subdivision.

- Account Dt. Formally, any account (not a group) can be specified as a debit account. But since this register is intended to account for production costs, it makes sense to indicate only subaccounts of cost accounts 20 “Main production”, 23 “Auxiliary production”, 25 “General production expenses” and 26 “General expenses”.

- Kt account. An account can be specified here that corresponds to the corresponding cost account.

- Cost item.

For example, if a division is not specified, then the record applies to all divisions of the organization. If a debit account is not specified, then the entry applies to all expense accounts. Etc.

The division into direct and indirect expenses occurs at the end of the month. The regulatory document “Closing accounts 20, 23, 25, 26” compares the turnover of cost accounts with the templates in the register “Methods for determining direct production costs in OU”. For those turnovers, taking into account analytics, for which corresponding templates were found in the register, expenses will be considered direct. If the template is not found for the existing turnover, then the consumption of this turnover is considered indirect.

For example, the entry highlighted in the previous figure with a red frame means the following. Material expenses for any cost item written off to any department on account 20.01 “Main production” from any credit account are direct.

If in this entry you indicate credit account 10.01 “Raw materials and materials” and assume that there are no other entries in the debit of account 20.01 “Main production”, then the expenses written off from account 10.01 “Raw materials and supplies” will be considered direct. The program will consider all other expenses written off to the debit of account 20.01 “Main production” to be indirect.

In the information register “Methods for determining direct production costs in NU” it is impossible to store general and detailed records valid for the same period, for example, as in the figure.

- First entry (general). It means that any cost items with the expense type “Material expenses” written off to any cost account from the credit of any corresponding account in any department are considered direct expenses.

- Second entry (detailed). This entry refers to direct expenses only those expenses that are written off as a debit to account 20.01 “Main production”.

It is easy to see that the second pattern is already included in the first. But what should the program do? Which instruction should I follow? After all, one contradicts the other. One of the entries needs to be deleted.

By default, the information register “Methods for determining direct production costs in NU” is not filled in. It must be filled out. When you click on the “Specify list of direct expenses” button, the program checks for the presence of entries in this register. If there are no entries, then she will offer to fill out the register in accordance with the recommendations of Art. 318 Tax Code of the Russian Federation. The generated list is not the only correct one. Therefore, the user has the right to edit it independently, guided by the provisions of Article 318 of the Tax Code of the Russian Federation.

If there is not a single entry in the information register “Methods for determining direct production costs in OU”, then the program will consider all expenses in tax accounting to be indirect.

The regulatory document “Closing accounts 20, 23, 25, 26” divides all expenses of the period into direct and indirect. Direct expenses form the actual cost of products (works, services) in tax accounting. All indirect expenses in tax accounting are written off to account 90.08.1 “Administrative expenses for activities with the main tax system.”

You can check the correctness of the division into direct and indirect costs using the “Production Costs Accounting Register” report. It allows you to separately generate a list of direct and a list of indirect costs.

Button “Specify income tax rates”.

If, with multi-company accounting, all organizations apply the same profit tax rates to the federal budget and to the budget of a constituent entity of the Russian Federation, then in the accounting settings settings, you must uncheck the “Different profit tax rates apply” flag. In this case, the “Specify income tax rates” button will display a form as in the figure.

This is a form of a periodic register of information “Income tax rates for all organizations.” It simultaneously displays the income tax rate for the federal budget and the budget of the constituent entity of the Russian Federation.

If different organizations with multi-company accounting are registered in different subjects of the federation, and they have different income tax rates, then in the accounting settings settings you need to set the flag “Different income tax rates apply”. In this case, the “Specify income tax rates” button will display a form as in the figure.

This is also a form of the periodic register of information “Income tax rates for all organizations.” But now it can only indicate the income tax rate in the Federal Bank of the Russian Federation.

Flag “PBU 18/02 Accounting for income tax calculations is applied.”

When the flag is set, the mechanism for keeping records of permanent and temporary differences in the valuation of assets and liabilities is activated in order to comply with the requirements of PBU 18/02.

VAT

Some VAT payers are characterized by fairly simple business transactions, while others are complex. In accordance with them, VAT accounting is divided into three levels of complexity in the configuration.

- Simplified VAT accounting.

- Regular VAT accounting.

- Full VAT accounting.

Simplified VAT accounting.

To maintain VAT accounting according to a simplified scheme, you need to set the “Simplified VAT accounting” flag. Simplified VAT accounting is valid only for rates of 18% and 10%. With this option, the flag “The organization carries out sales without VAT or with 0% VAT” becomes inactive. This means that with simplified VAT accounting it will not be possible to reflect transactions without VAT or at a VAT rate of 0%.

With simplified VAT accounting, only two pairs of relevant documents are used: the receipt document and the “Invoice received” document.

In order for the result to be reflected in the purchase book in the “Invoice received” document, you must set the “Reflect VAT deduction” flag.

There is no need to create regulatory documents “Creating Purchase Ledger Entries” and “Creating Sales Ledger Entries”.

In organizations where the operations listed below take place, setting the “Simplified VAT accounting” flag is highly undesirable.

- Deductions for purchased fixed assets are accepted after they are put into operation.

- Certain types of activities have been transferred to the payment of UTII.

- The organization plays the role of a tax agent.

- Construction and installation work is taking place.

- Export-import operations take place.

- It is necessary to take into account positive amount differences.

Otherwise, the user will have to take control of tracking events related to the correct accounting of VAT and actually manually register them on time using the documents “Reflection of VAT for deduction” and “Reflection of VAT accrual”.

The documents “Reflection of VAT for deduction” and “Reflection of VAT accrual” are also used in cases where the receipt and sale of goods (work, services) is recorded by manual operations (accounting certificate).

Regular VAT accounting.

Regular VAT accounting, like simplified accounting, is used only for rates of 18% and 10%. To implement regular VAT accounting in the “Accounting Policies of Organizations” information register, on the “VAT” tab, you must perform the following steps.

- Remove the flag “The organization carries out sales without VAT or with 0% VAT.”

With regular VAT accounting, all restrictions on simplified VAT accounting are removed, with the exception of export-import transactions. Specialized documents work correctly.

- VAT restoration.

- Reinstatement of VAT on real estate.

- VAT accrual for construction and installation work (economic method).

- Confirmation of zero VAT rate.

- VAT distribution of indirect expenses.

- Registration of VAT payment to the budget.

- VAT write-off.

Regular VAT accounting involves the creation and posting of regulatory documents “Creating purchase ledger entries” and “Creating sales ledger entries” at the end of each reporting period.

If the organization does not have tax features, then the difference between regular and simplified VAT accounting is only the need to quarterly create regulatory documents “Creating purchase ledger entries” and “Creating sales ledger entries.”

Simplified VAT accounting can be a piece of cheese in a mousetrap. It's better not to use it anyway.